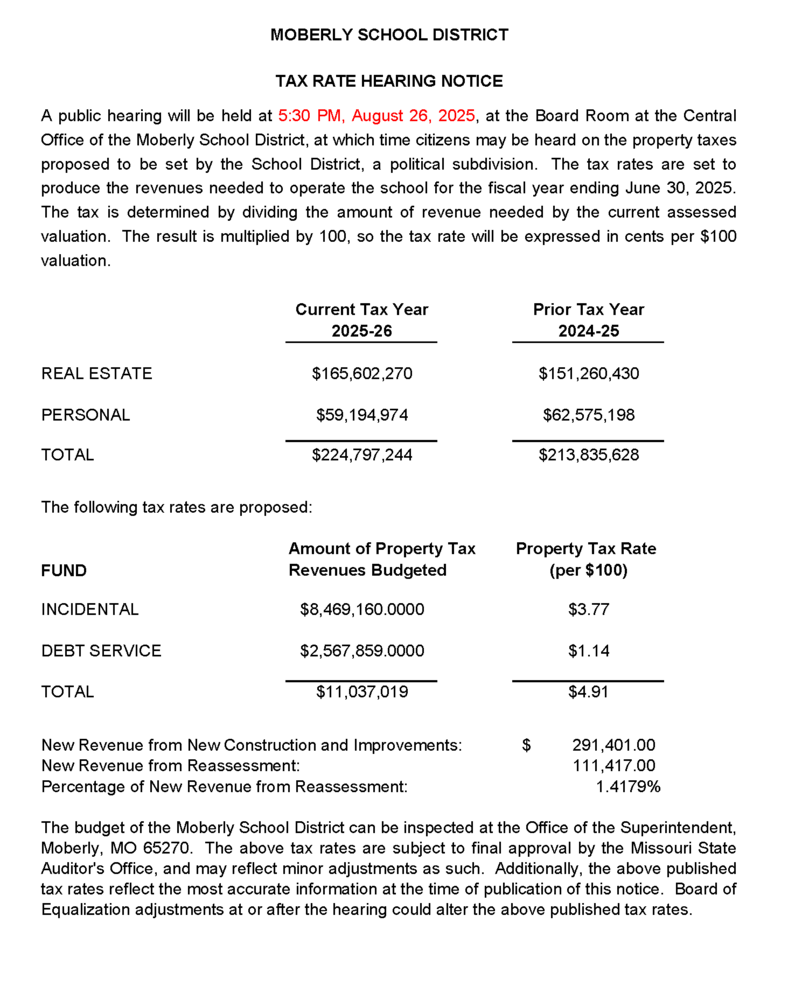

A public hearing will be held at 5:30 PM, August 26, 2025, at the Board Room at the Central Office of the Moberly School District at which time citizens may be heard on the property taxes proposed to be set by the School District, a political subdivision. The tax rates are set to produce the revenues needed to operate the school for the fiscal year ending June 30, 2026. The tax is determined by dividing the amount of revenue needed by the current assessed valuation. The result is multiplied by 100, so the tax rate will be expressed in cents per $100 valuation.

The budget of the Moberly School District can be inspected at the Office of the Superintendent, Moberly, MO 65270. The above tax rates are subject to final approval by the Missouri State Auditor's Office and may reflect minor adjustments as such. Additionally, the above published tax rates reflect the most accurate information at the time of publication of this notice. Board of Equalization adjustments at or after the hearing could alter the above published tax rates